Many people have the aspiration of retiring early, but the actual age at which one retires depends on various factors.

Some individuals may choose to retire when they are eligible for the age pension, while others may opt to do so when they can access their Superannuation.

While it was once customary to retire at age 55, these days ideal retirement age differs for each person. Regardless of the chosen age, several factors are likely to influence the decision.

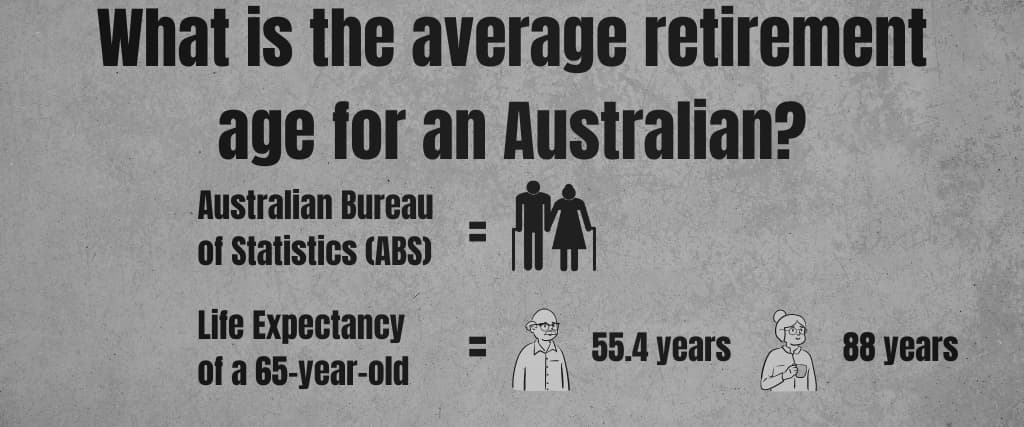

What is the average retirement age for an Australian?

The Australian Bureau of Statistics (ABS) reports that the average age people retiring in Australia is 55.4 years.

Subsequently, with the life expectancy of a 65-year-old being 85.3 years for men and 88 years for women, it is crucial to carefully consider how we will finance our retirement, as many of us may be retired for a lengthy period of time.

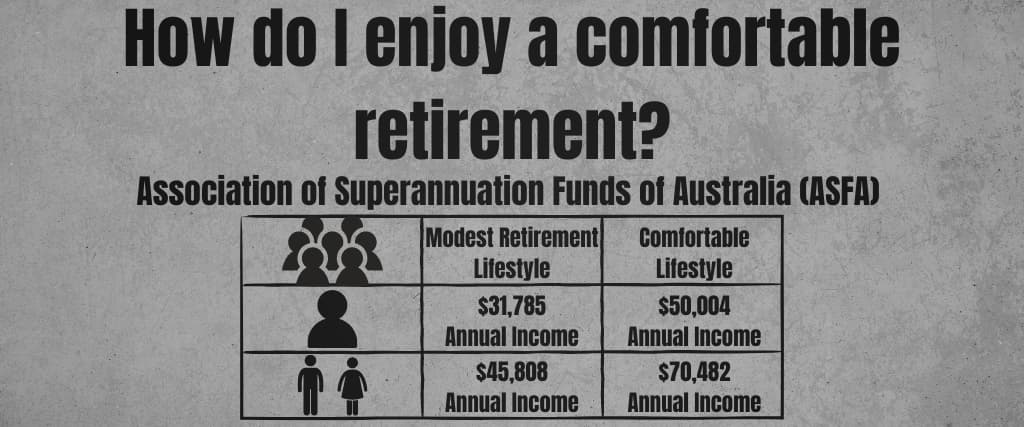

How do I enjoy a comfortable retirement?

The Association of Superannuation Funds of Australia (ASFA) has published the AFSA Retirement Standard 3, which provides guidance on the income needed for a modest or comfortable retirement.

These figures assume that you own your home and are in good health. For a single person aged 65, a modest retirement lifestyle requires an annual income of $31,785, while a comfortable lifestyle requires $50,004. For a couple around the same age, the figures increase to $45,808 for a modest lifestyle and $70,482 for a comfortable lifestyle.

A modest retirement lifestyle is better than relying solely on the age pension and allows for basic activities. A comfortable retirement lifestyle, on the other hand, includes a broad range of leisure and recreational activities, allowing for a good standard of living.

This lifestyle also includes the ability to purchase household goods, private health insurance, a reasonable vehicle, quality clothing, electronic equipment, and even enjoy holidays both domestically and internationally. These guidelines serve as a starting point to determine the category that you would like to fall into and help you to estimate how much money you will need.

What is the Age pension Minimum, and am I eligible for it?

The age pension is a financial aid that assists retirees in covering their living expenses. To qualify, you must be 66.5 years old or above and satisfy specific income and asset criteria.

It’s worth noting that the age threshold for the age pension increased to 67 years on 1 July 2023 for those who missed the 66.5-year cut-off by 30 June 2023. Overall, your eligibility for the age pension depends on your date of birth.

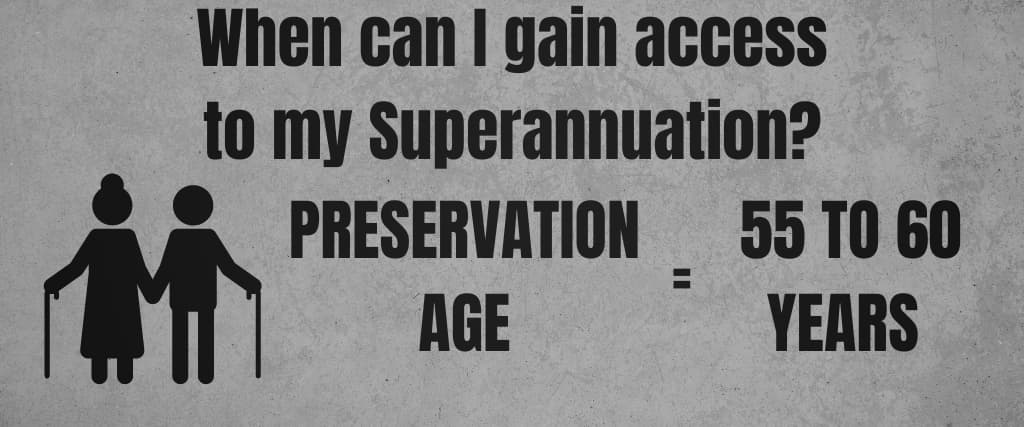

When can I gain access to my Superannuation?

Once you reach your preservation age, which varies from 55 to 60 years, depending on your birth date, you can access your super.

However, there are certain situations, such as severe financial hardship or permanent disability, that allow you to access your super benefits before your preservation age.

| Statistic | Value |

|---|---|

| Number of retirees | States with the highest proportion of retirees: |

| Percentage of people over 55 who were retired | 55% (up from 53%) |

| Average retirement age (all retirees) | 55.4 years |

| Number of people intending to retire within 5 years | Half a million |

| Percentage of female retirees who relied on their partner’s income | 65.5 years |

| Percentage of retirees who relied on pension as main income | Majority |

| Percentage of female retirees | 55% |

| Reasons for leaving the last job: | 36% |

| Reasons for leaving last job: | |

| – Reached retirement age or eligible for superannuation | 46% |

| – Own sickness, injury, or disability | 21% |

| – Retrenched, dismissed, or no work available | 11% |

| Weighting and benchmarking | |

| – Government pension | Majority |

| – Superannuation | More men than women |

| Factors influencing retirement decision: | Financial security |

| Reasons for leaving the last job: | Tasmania and South Australia |

| States with the highest proportion of retirees: | New South Wales |

| Adjustments made to the Retirement and Retirement Intentions survey | State with the highest increase in retirees: |

| Change in retirement definition | Minimum prior employment requirement removed |