| Statistics | Data |

|---|---|

| Number of Age Pension recipients | 2.6 million as of March 26, 2021 |

| (62% of the population aged 65 and over) | |

| Age Pension rates on average | Single person: $1,064 per fortnight |

| Couple (per person): $802 per fortnight | |

| Couple (combined): $1,604 per fortnight | |

| The Age Pension’s Importance | Supports approximately two million Australians |

| over the age of 65 | |

| Age requirements | Age eligibility: 67 years |

| (gradually increasing since 2009) | |

| Population statistics | 4.2 million people aged 65 and over as of June 30, 2020 |

| (approximately 16% of Australia’s total population) | |

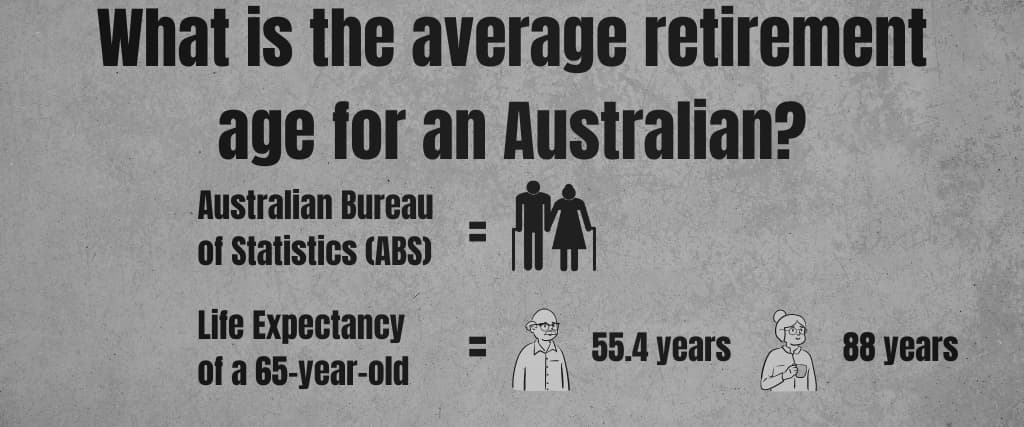

| Statistics on retirement | Retirees aged 55 and above: 55% |

| Average retirement age: 55.4 years | |

| Age at which people plan to retire | Average retirement age: 65.5 years |

The Age Pension is a crucial component of Australia’s social security system, providing financial support to over 2 million elderly citizens who have retired from the workforce.

Understanding the latest Age Pension statistics becomes vital for policymakers, researchers, and the general public as the population ages.

This article aims to provide an overview of the Age Pension statistics in Australia for 2023, shedding light on key demographic trends, expenditure patterns, and the overall impact on the nation’s economy.

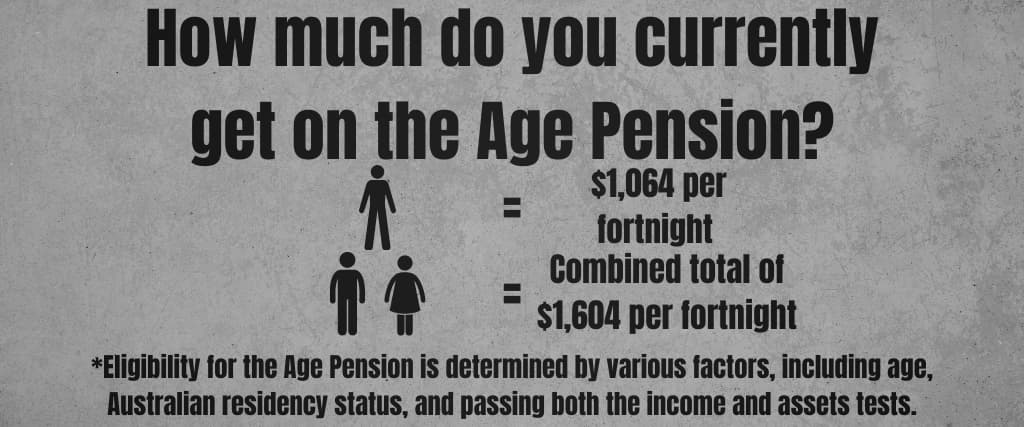

How much do you currently get on the Age Pension?

Determining the Age Pension rate is not a one-size-fits-all scenario. If you meet the criteria to receive the pension, your payment amount will be based on your income and assets.

Eligibility for the Age Pension is determined by various factors, including age, Australian residency status, and passing both the income and assets tests.

However, at present the maximum you will receive as a single person is $1,064 per fortnight. By contrast, couples receive a combined total of $1,604 per fortnight.

Who is eligible for the Age Pension?

On the 1st July 2023, the Age Pension age increased to the age of 67. Previously it was designated for those aged 66 years and 6 months and older.

To qualify for the Age Pension, it is necessary that you meet the residency requirements as an Australian resident. This implies that you must have lived in Australia for a minimum of ten years, with at least five years being consecutive, and not coming and going during that period.

However, some exceptions to the ten-year residency requirement exist. These include being a refugee or a family member of one, being an Australian resident widow for the past two years, receiving an Australian Widow’s Pension before reaching the eligibility age or having lived or worked in a country that has an international social security agreement with Australia.

How many people get the age pension

As of March 26, 2021, some 2.6 million Australians received the age pension. This translates to about 62% of the total population of adults aged 65 and over.

Income test

To be eligible for the Age Pension, your income should not exceed a certain limit. For a single person, this limit is set at $204 per fortnight, beyond which their pension payment will be reduced by 50 cents for every dollar earned. Couples, on the other hand, can earn up to $360 per fortnight before their payments get reduced.

As per the rules, a single person can earn a maximum of $2,332.00 per fortnight, while couples can earn up to $3,568.00 per fortnight. Exceeding these limits will result in the cessation of your Age Pension payment.

When determining your eligibility for financial assistance, the income test takes into account various sources of income, such as returns on investments, income from your superannuation fund, rental income from investment properties, employment income, and even deemed income. Deemed income refers to the amount of income Services Australia assumes you earn from owning certain assets, regardless of whether you actually receive that amount.

However, if you are earning employment income, there is a Work Bonus program that allows you to earn above the income limit without affecting your pension rate. You can earn $300 per fortnight as a maximum or generate a balance of $11,800 in your Work Bonus to offset any employment income accrued throughout the year.